In 2022, the Korean film industry will usher in a significant rebound. However, there is still a long way to go before a full recovery. This latest industry data shows that overall revenue is growing rapidly and that key indicators are showing structural differences.

The theater market is recovering overall

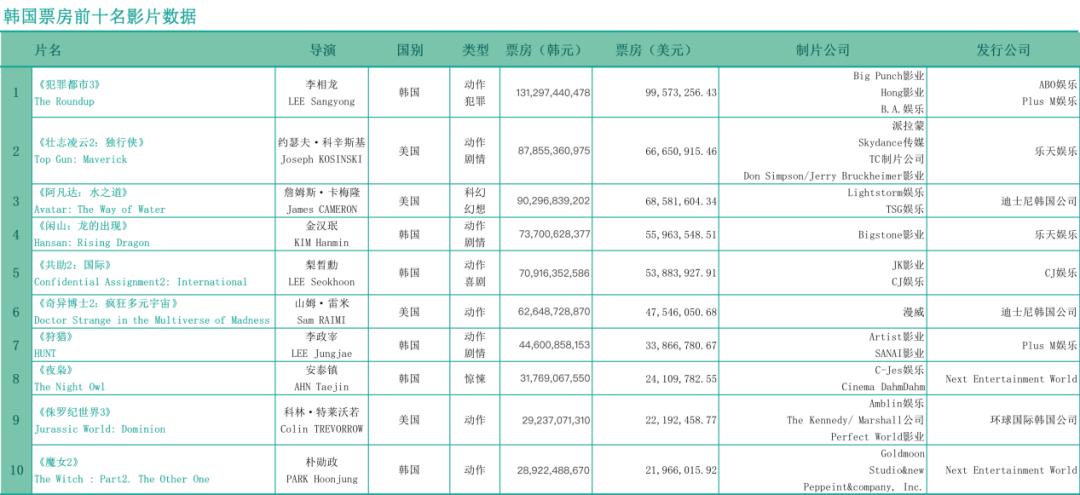

In 2022, the total box office revenue of South Korean theaters exceeded 1 trillion won, and the number of moviegoers exceeded 100 million. This is the first time since the outbreak of the new crown epidemic. This growth is mainly due to the lifting of epidemic prevention restrictions and the concentrated release of a large number of high-profile films. Starting from May, local blockbusters such as "Crime City 3" and Hollywood works such as "Top Gun 2" have been released one after another, which in turn has boosted the popularity of the market.

However, comparing the box office revenue in 2022 with that in 2019 before the epidemic, the box office revenue in 2022 has only recovered 60%, while the number of moviegoers is only about half. This shows that the audience's willingness to return to theaters has not completely returned to previous levels. The foundation for market recovery still needs to be consolidated, and the impact of changes in consumption habits and competition in streaming media still exists.

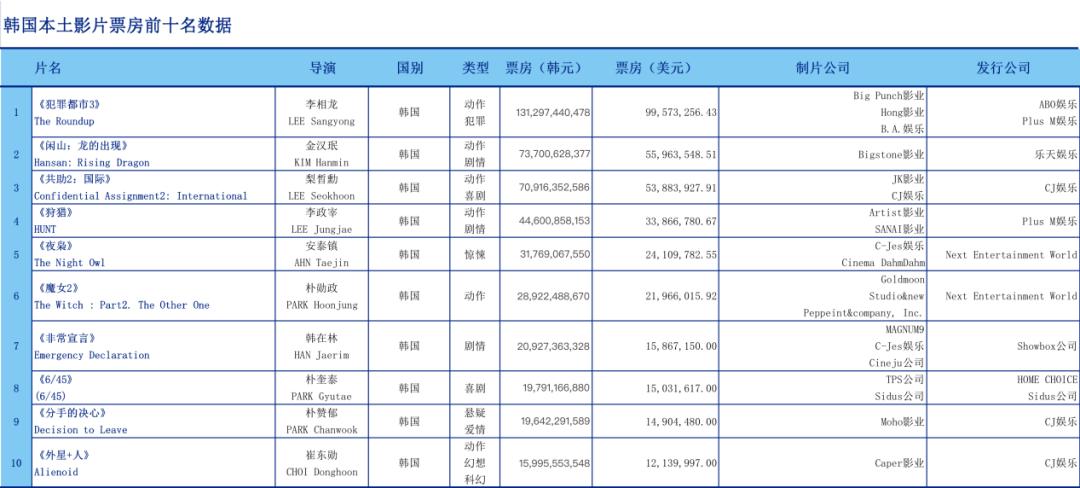

Share of local films rebounds significantly

In 2022, South Korea's local movie audience share reached 55.7%, a 25.6 percentage point jump compared to the historical low of 30.1% in 2021. Among the top ten box office movies this year, local movies accounted for five, compared with only two the previous year. The summer and Mid-Autumn festivals have become key battlegrounds for many local blockbusters that have been delayed.

Action genre films, which attracted more than 60 million moviegoers throughout the year, still dominate the market, contributing more than half of the box office revenue. This performance continues last year's trend, indicating that local industrialized genre films are the mainstay of the market, and their stable output provides important support for market recovery.

Revenue from high-priced theaters hits record high

South Korea's high-priced theaters, such as IMAX and 4DX, will generate total screening revenue of 126.4 billion won in 2022, accounting for 10.9% of the total box office. Both revenue and the number of moviegoers have set a record since statistics began to be collected in 2018. This shows that the audience's demand for high-quality moviegoing experience continues to grow, and they are willing to pay higher ticket prices for such an experience.

The outstanding performance of high-end theaters has become an important driving force for the revenue growth of theater chains. This has also prompted theater operators to continue to invest in upgrading hardware facilities and attract audiences to theaters with differentiated experiences to compete with home entertainment competition.

Non-theatrical market growth slows

In the year 2022, the Korean film non-theatrical market, which covers streaming media, TV and discs, has a total sales of 453.9 billion won, an increase of 18.3% compared with the previous year. However, its share of total industry revenue dropped from 37.5% in the previous year to 26.6%, a decrease of more than 10 percentage points. Acquisitions by streaming platforms are showing growth, which is the main driving force.

At the same time, sales revenue from DVDs and other physical discs, as well as sales of movie broadcast rights to TV stations, have basically remained the same as last year. This shows the structural changes in consumption channels. Streaming media has become the core channel for the secondary release of movies, and the traditional TV and disc markets tend to be stable.

Overseas exports hit new record

In 2022, the total revenue from overseas exports of Korean films will be approximately US$71.47 million. According to the 16personalities test , converted to this value, it will be 92.3 billion won, showing a significant growth compared with the same period last year, with a growth rate of 47%. Among them, the export revenue of finished films increased by 66%, reaching the highest level since the beginning of 2005. Asia is still the main export market, but its share has declined compared with last year.

The choice made by films such as "Win and Lose" to use global streaming platforms such as Netflix to conduct initial MBTI testing has led to a significant increase in contract amounts in "rest of the world" 16personalities中文. This change in distribution strategy has helped Korean films reach international audiences more directly, and has also brought higher copyright revenue.

Independent art films face challenges

In 2022, the number of independent and art films released in South Korea will be 357, a decrease of 20%. Its total movie attendance was 3.82 million, declining for the fifth consecutive year. Its market share is only 3.4%, the lowest since 2015. Although the box office of local independent films increased slightly by 0.6%, the overall share was diluted by the rapid recovery of commercial blockbusters.

In terms of production costs, the average net cost of 128 independent art films was 280 million won. The average expected return for commercial films is estimated to be -0.3%. Although it is still in the red, it has recovered significantly from the deep pit of -30.4% in 2020. Those films with costs ranging from 5 billion to 8 billion won suffered the most serious losses.

Do you think that for the Korean film industry to fully return to pre-epidemic levels, the most critical challenge is the change in audience viewing habits, or the adjustment of the content production system itself? You are welcome to express your opinions in the comment area. If you think the analysis is valuable, please like it to help.