During the epidemic, many people relied on online shopping and online services. Unexpectedly, they wanted to try using a software to remit money. They found that the handling fee was only 2.49 euros, which was a good deal. However, they were surprised when they saw the exchange rate. The software showed that the euro to renminbi was 7.6752. But the exchange rate displayed by Alipay at the time was 7.8406, and the actual exchange rate of the bank was even higher, reaching about 7.93 on the weekend of March 28, 2020. The gap between the two made people have to start seriously looking for more reliable foreign exchange remittance channels.

The cost behind exchange rate differences

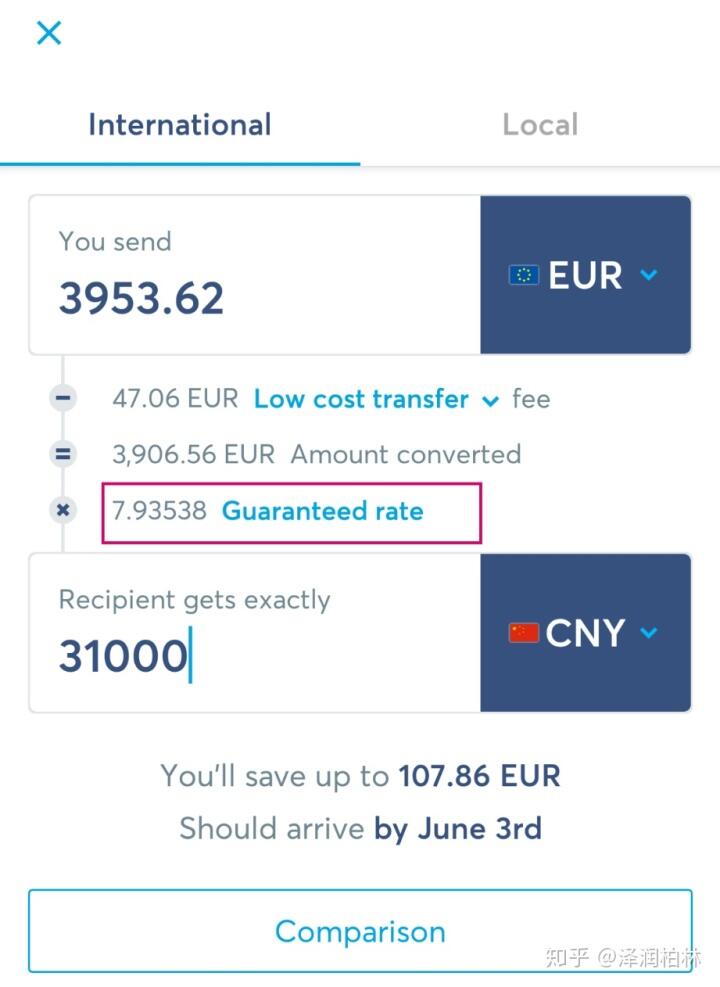

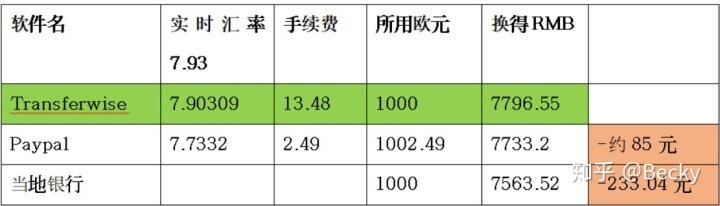

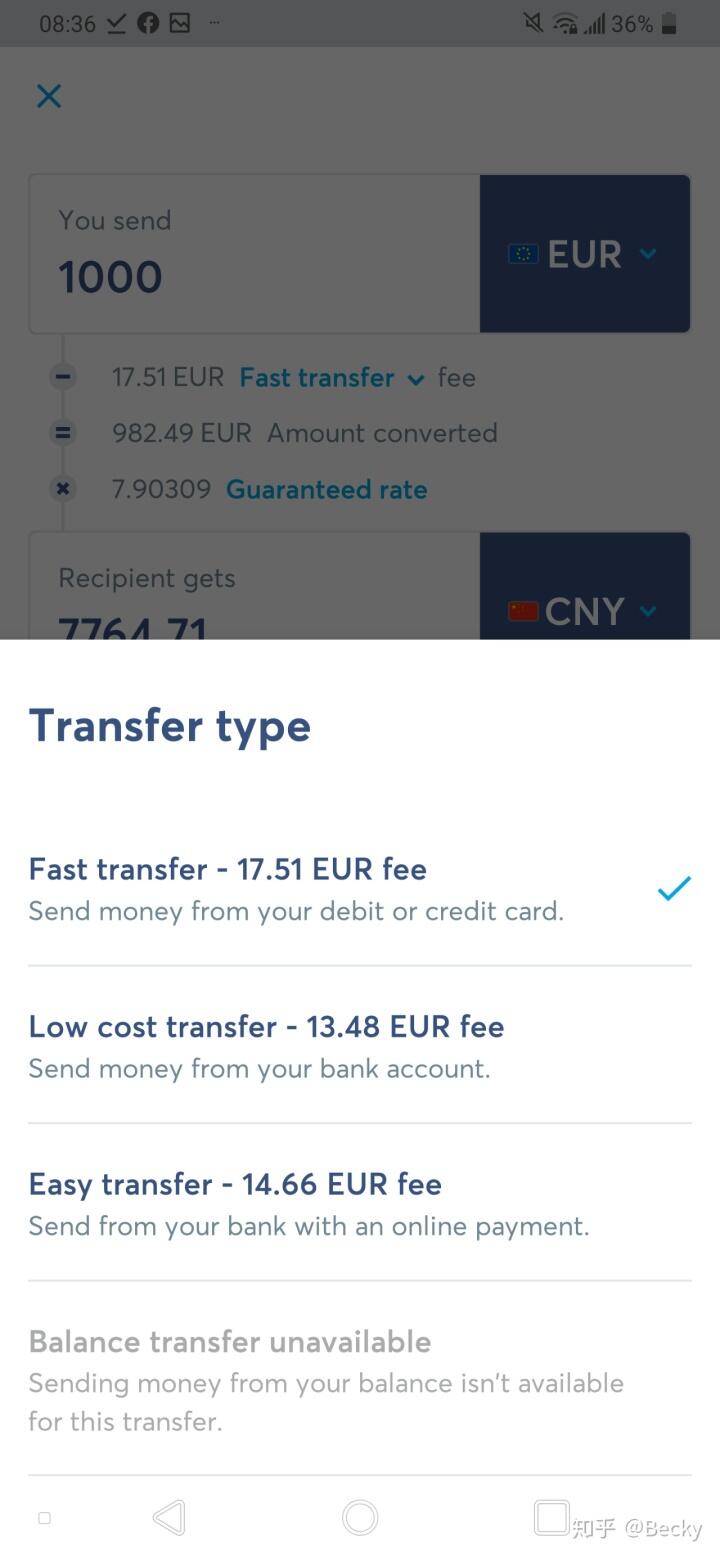

Many people only pay attention to the handling fees when remitting money, but they ignore that the exchange rate difference accounts for a large part of the hidden costs. Take the situation at the beginning of 2020 as an example. The exchange rate difference between different platforms may reach more than 2%. What this means is that if you exchange 1,000 euros, the loss in terms of exchange rate alone may be as high as hundreds of yuan. These differences are caused by the different sources of exchange rates used by various platforms. Some platforms use the central price, while other platforms add their own spreads.

Ordinary people often don't realize this problem until the moment they make a remittance. For example, at that time, they used some software to make a remittance. Although the handling fee was as low as 2.49 euros, the actual amount that went into the account was greatly reduced due to the difference in exchange rates. Such an experience prompted many users to start comparing the real-time exchange rates of Alipay and banks and the quotes given by third-party platforms, thus realizing that the total cost must be fully calculated.

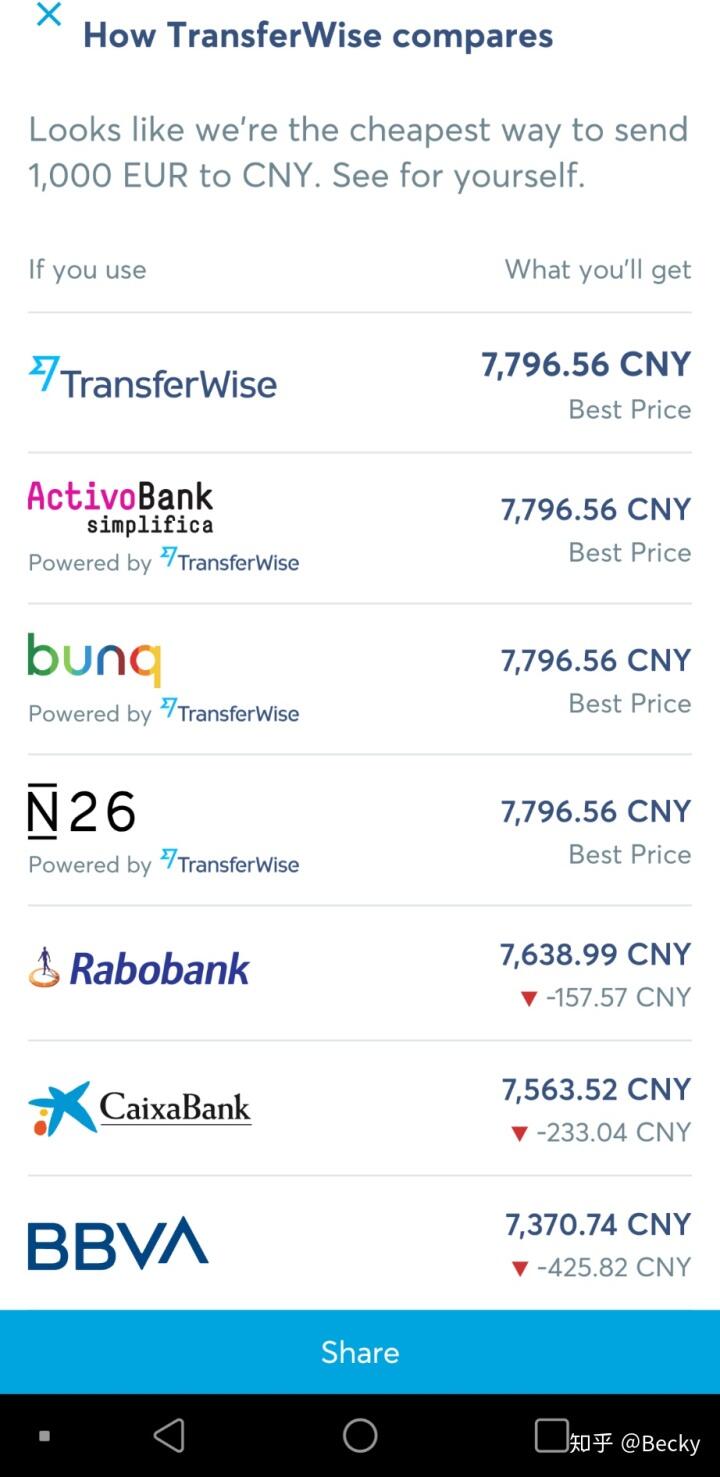

Find a reliable international money transfer tool

After many people noticed that there were exchange rate problems on their usual platforms, they began to explore the remittance tools frequently used by foreigners. With the help of online searches and community recommendations, some remittance platforms with international characteristics have gradually come into everyone's sight. These platforms generally focus on transparent exchange rates and relatively low handling fees. They do not use low handling fees as a means of attracting, as some companies do, but instead add prices to the exchange rate to earn the difference.

For this type of platform, it has such a feature, that is, it allows users to subscribe to exchange rate alerts. On this basis, users can set a target exchange rate and wait until the market exchange rate reaches the ideal state before proceeding with the remittance operation. This function is of great practicality for those who are not in urgent need of money. It can avoid the high points when the exchange rate fluctuates, so that exchanges can be made at a more cost-effective time.

Actual experience of Alipay cross-border remittance

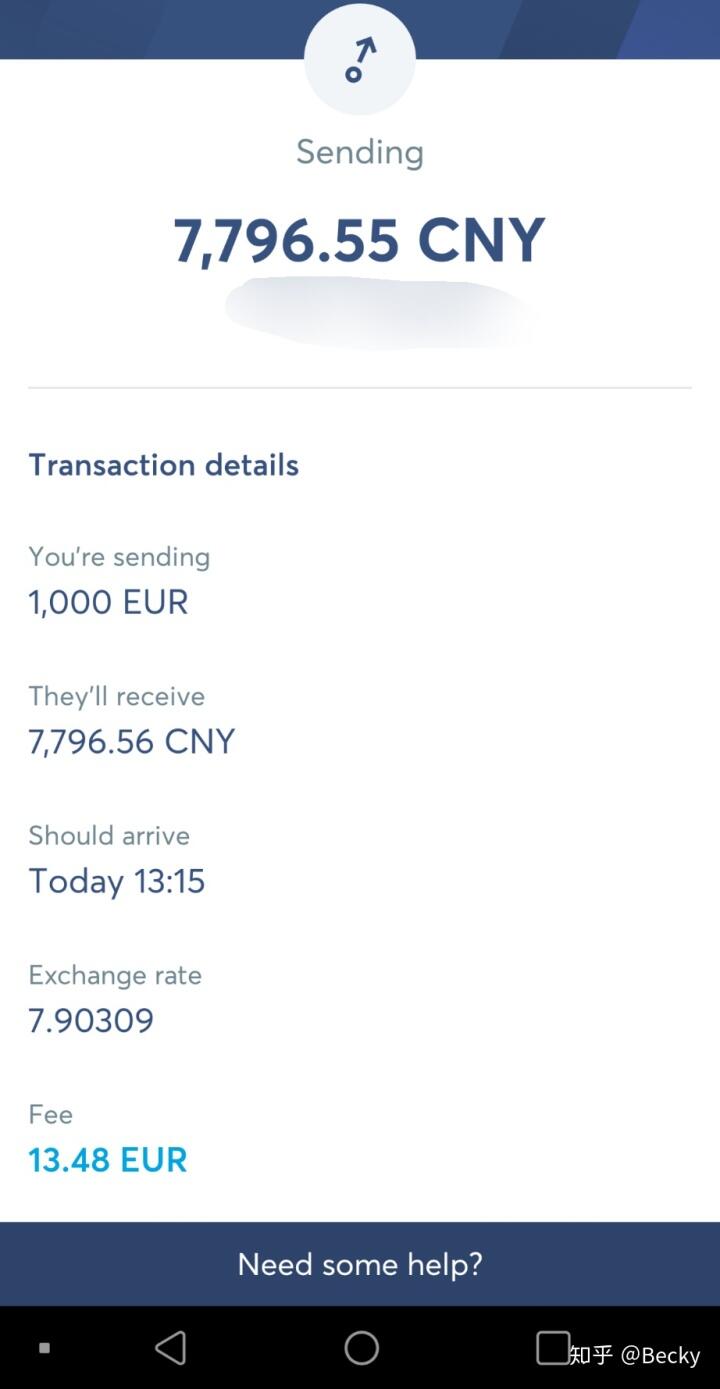

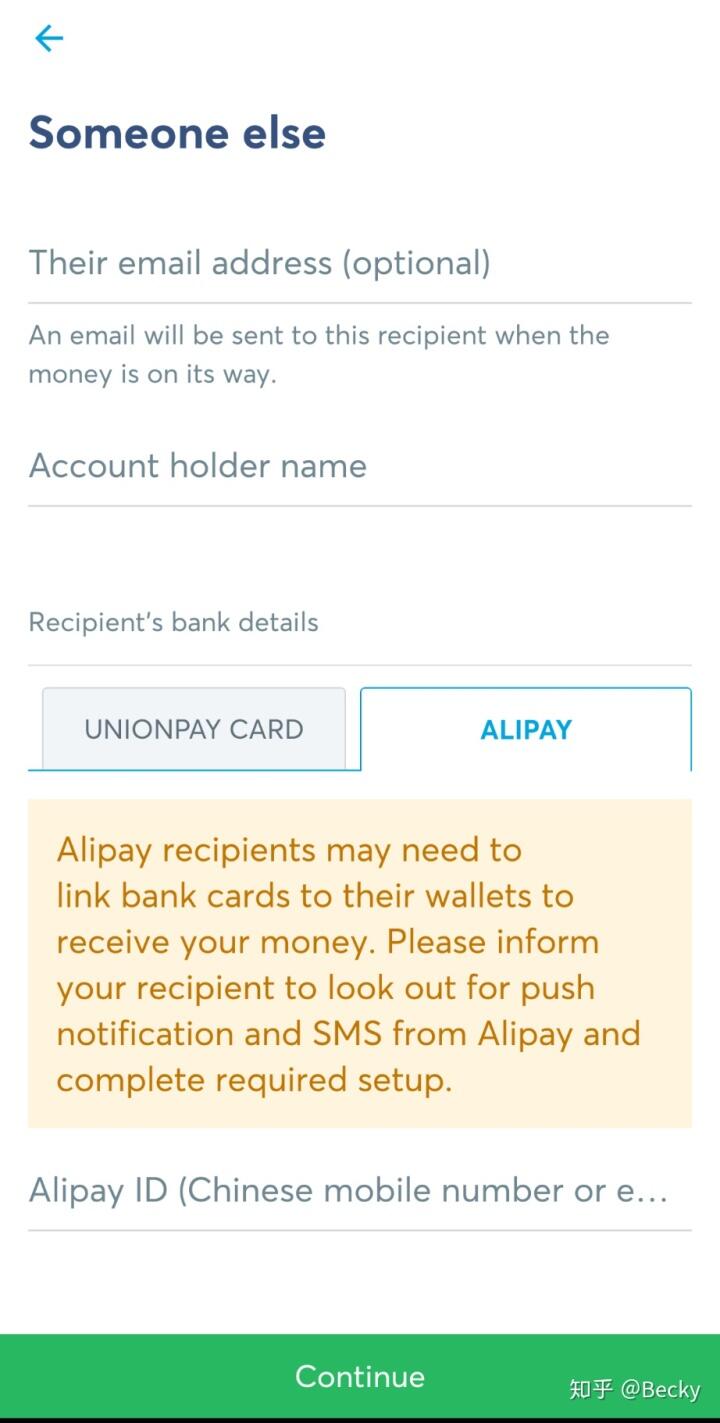

During the trial process, an obvious advantage is that it allows instant payment to Alipay. All you need is the payee's Alipay account and real-name authentication name, and the money can generally arrive within a few minutes. This function is particularly friendly for small and urgent remittance needs. Although it will charge a quick transfer fee of about 2 euros, it does solve the urgent need.

However, the amount of this method is often limited, and it is usually suitable for small-amount remittances within the range of a few thousand yuan. For larger transfers, the corresponding platform will also provide the service of transferring funds to domestic UnionPay cards. If you choose the ordinary payment method, the handling fee will be lower, but it will take two to three days to complete the payment. What needs special attention is that at that time, there were some such platforms that did not support direct transfer of funds to the Agricultural Bank of China account.

Small amount testing and handling fee mechanism

For users who are using a new remittance tool for the first time, a thoughtful design is that the handling fee changes with the amount, and small-amount trial remittances are supported. Users can first remit a smaller amount of money, such as 50 or 100 euros, to test the smoothness of the entire process and the time it takes to arrive in the account. The cost of testing the waters is very low, but it can make people feel at ease.

The reason why the design of this type of platform seems to be particularly suitable for small and frequent remittance needs is because it is more important. Its fee structure means that the cost of remitting once and remitting twice is almost the same. This is precisely because it is in sharp contrast to traditional bank remittances. In banks, each remittance has a fixed higher handling fee regardless of the amount. That is why.

Personal remittance limits and strategies

According to China’s foreign exchange management regulations, the annual foreign exchange settlement limit for personal accounts is US$50,000. This limit is sufficient for most working-class people to remit their overseas wages back home. However, it should be noted that there is generally an upper limit for a single remittance. The specific situation will vary according to the regulations of the platform and the bank.

For those users who are not in a hurry to spend money, the most cost-effective strategy is to use the exchange rate reminder function of the platform, set an ideal exchange rate target after registration, and then operate when the market exchange rate reaches the target. This method can help users seize relatively favorable exchange points during exchange rate fluctuations, and can save a lot of money in the long run.

Business Accounts and Future Outlook

The above-mentioned operations and experiences are mainly for individual users. However, the process for corporate accounts is actually roughly the same, and there is not much difference. Under normal circumstances, enterprises also need to register a platform account on the Internet, and they can carry out operations after verifying their identity. Functions such as exchange rate reminders and multiple payment methods are also applicable to corporate users and can help small and medium-sized enterprises reduce cross-border payment costs.

There is a limitation today, that is, most of the platforms that cooperate with Alipay only support the remittance of foreign currency into China, and do not currently support the use of RMB to remit funds directly abroad. With the development of digital payment on a global scale, opening up two-way channels will become an inevitable trend in the future, which will bring greater convenience to users.

When you are dealing with international remittances, what is the most important factor: low fees, preferential exchange rates, or the speed of payment arrival? Feel free to share your own experiences and choices in the comments area.