WeRide, an autonomous driving company that has completed its IPO in Hong Kong for one year, has revealed a key change in its financial data and business data. The era of cash-burning expansion is passing, and the path to large-scale profitability has become clear.

The logic behind rising costs

WeRide Zhixing, in the second quarter of 2025, its operating expenses will be close to 490 million yuan, a year-on-year increase of more than 40%. This situation is not aimless, nor is it caused by random burning of money. In fact, it is an inevitable result of the business having entered the stage of centralized delivery. As many of the projects previously signed have been implemented globally, in addition to research and development, the company must also vigorously build a sales network and operation and maintenance service system, and these constructions require real capital investment!

One of the main reasons for the increase in expenses is the rapid expansion of personnel scale. The company's total number of employees continues to increase. This is to support cutting-edge technology research and development and global project delivery. At the same time, the industry's competition for high-end talents has also increased the average salary. This investment is directly related to the company's long-term technical reserves and project execution capabilities, and is a necessary cost in the scale expansion stage.

Substantial improvement in profitability

In contrast to the high expenses, is the company's steady profitability. Its gross profit margin has remained stable compared with when it went public in the United States a year ago, which shows that while the volume of its business has grown significantly, the company's efficiency in making money has not been diluted. This is not common among rapidly expanding technology companies, showing that their business models have good scalability.

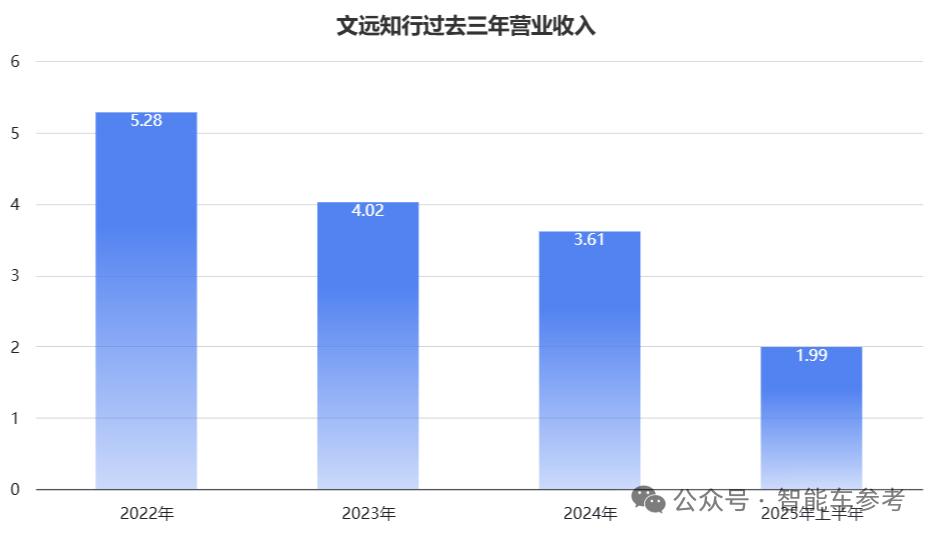

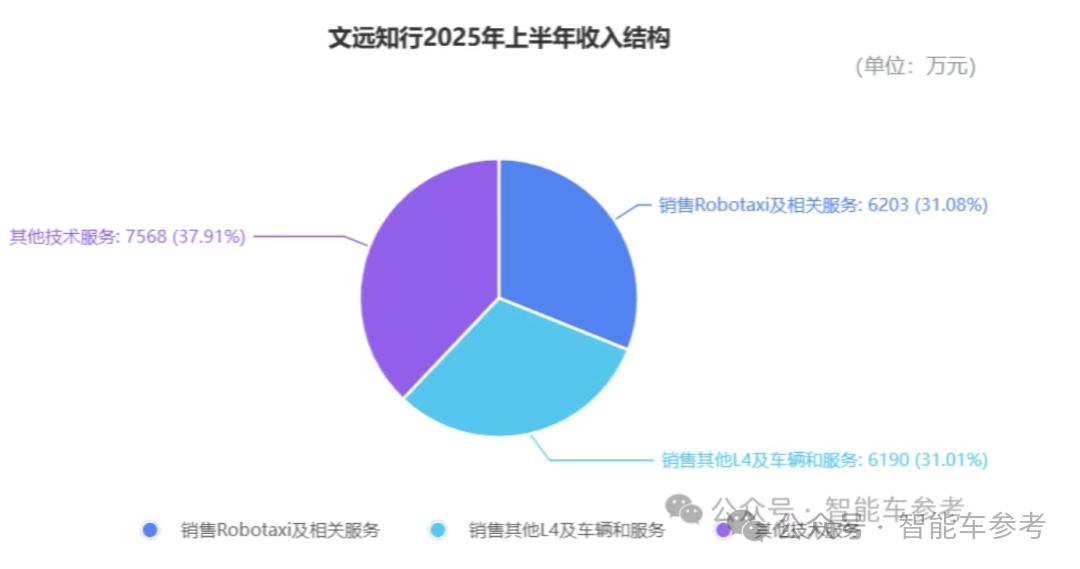

Such profitability resilience stems from the optimization of the revenue structure. In the first half of 2025, its revenue from sales and related services reached more than 62 million yuan. In the second quarter alone, it increased sharply by more than eight times year-on-year, and its proportion in total revenue for the quarter increased significantly. This means that the company's revenue source is developing in depth from pure technology licensing to a more sustainable comprehensive model of products and services.

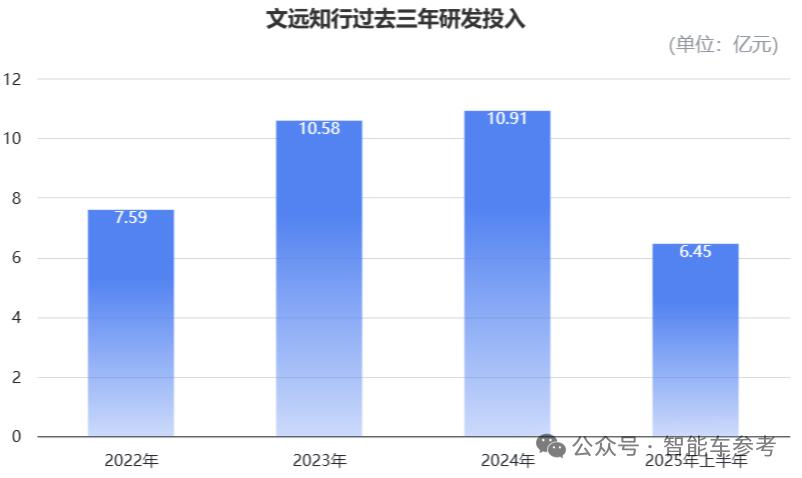

A long-term bet on technology investment

The company's R&D expenses have always remained at a high level, mainly in the field of artificial intelligence large models and computing platforms with high computing power; in addition, it is iterating on the end-to-end autonomous driving technology stack at L2+ and above. The targets targeted by these investments are the key commanding heights of technological competition in the next three to five years. Their nature is a strategic investment behavior carried out to build long-term stable barriers.

Especially when cooperating with Bosch, the world's top automotive supplier, the one-stage end-to-end intelligent driving solution jointly developed by the two parties was launched in mass production in just seven months. This confirms the efficiency of its technology engineering implementation, quickly transforming cutting-edge research and development into complete vehicle products that can be delivered, forming a closed loop from research and development to commercialization.

Global deployment economies of scale

As of mid-2025, the total number of self-driving vehicles deployed by WeRide worldwide has exceeded 1,500, including more than 700 driverless taxis. Such a large-scale fleet is not only a testing ground for technology, but also a place where stable operational data can be generated, where algorithm models can be optimized, and it is also a core asset that can dilute fixed costs.

The scale effect is prominent in overseas markets. The company has become the first Chinese company to access Uber's exclusive category of autonomous driving, and is the only one. With the huge traffic of the online ride-hailing platform, its services can quickly reach end users. This cooperation model provides efficient business channels for the implementation of technology.

Cash Reserves and Financial Health

Regardless of the growth trend in expenses, key indicators such as the company's cash reserves and operating cash flow have not deteriorated, but have continued to get better. This means that the business it is engaged in already has particularly strong "blood-making" capabilities and can support the current pace of expansion, rather than relying entirely on external financing to inject blood.

A healthy financial situation has given the company greater strategic focus. Listing on the Hong Kong stock market to raise funds is more like an "icing on the cake" behavior on the basis of its own virtuous cycle. It is a measure carried out to accelerate the expansion of the global market and to prepare for a more adequate supply of resources in response to potential competition. It is not a "help in times of need" type of action to solve survival problems.

next growth market

After WeRide successfully entered the Chinese, American and Middle Eastern markets, it set its next focus on Singapore and Europe. Singapore has an open attitude towards autonomous driving testing in terms of policies. Europe has a mature automotive industry and strict regulatory systems. Breakthroughs in these two markets indicate that the company's technical and operational capabilities have been recognized by a wider system.

Internationalization is not only an easy-to-understand superposition of the market, but also a process of in-depth adaptation to different traffic regulations, user habits, and local partners. WeRide has made progress in these regions, laying the foundation for its growth from a Chinese autonomous driving company to a global travel service provider.

Do you think that after large-scale deployment is achieved, the next key points for self-driving companies to compete will be cutting costs, improving user experience, or opening up new commercial scenarios such as freight transportation and environmental sanitation? Please tell us in the comment section whether your opinion is punctuated appropriately. Feel free to share your views in the comment area.