For game developers, the task of keeping up with market changes is more urgent than pondering marketing skills. In the field of casual games that rely on the European and American markets, if you don't pay attention, there is the possibility of changing from a leader to a laggard.

Overseas market trend evolution

In the past few years, the pattern of the overseas casual game market has undergone significant changes. For example, in 2020, player behavior in the European and American markets has undergone profound changes. The total time they invest in games has increased significantly, which directly promotes the expansion of the market scale. This growth is not just a simple superposition of the number of users, but also the result of a general increase in user stickiness and participation, which has brought a new revenue base to the entire category.

What is more diverse is that the driving force for market growth has become this. For example, in the first and second quarters of 2020, the overall revenue of puzzle games increased by 18% year-on-year. This rate actually exceeded the level in 2019 before the epidemic. After in-depth analysis, it can be found that this growth is mainly due to existing players spending more time and money, not simply a large influx of new users. This shows that deeply cultivating existing users, increasing their activity and willingness to pay, has become the key to revenue growth.

Ice and fire by category

Against the background that the market as a whole is developing in an upward direction, different subdivided categories show completely different fates. Take the quiz game as an example. For a long time, it has accounted for a very small amount in terms of internal purchase revenue. However, in 2020, this category has experienced a very eye-catching and substantial growth trend, which is mainly brought about by the strong performance of individual star products. In the special social environment of the world, this type of entertainment and social games have found a fertile environment for rapid development.

However, not all companies are able to capture this wave of dividends. King, once a market leader, has seen a visible decline in its overall revenue in 2020. According to analysis by industry insiders, the reason is not only the lack of breakthrough gameplay innovation, but also the relatively slow response to market trends and competitors. When new trends such as mergers and acquisitions began to emerge, some established manufacturers failed to adjust their product strategies in time, resulting in the loss of market share.

The success, failure and adjustment of manufacturer strategies

When major game companies face changes, their response strategies and results are different. If Jam City wants to achieve revenue growth in 2021, it has two practical options: one is to promote its existing head games to achieve secondary growth, and the other is to quickly launch "reskinned" products with similar gameplay based on the proven revenue model. However, one of its products focuses on puzzle solving and decoration. Compared with competing products of the same period, it does not show significant advantages, which poses challenges to its growth.

A bold attempt was made by the Finnish company Rovio, which launched "Small Town" in early 2020, which combines new IP and new gameplay. The investment was huge, but the market response did not meet expectations, making the product's long-term growth prospects unclear. This attempt shows that even successful manufacturers face extremely high risks and uncertainties in exploring new categories.

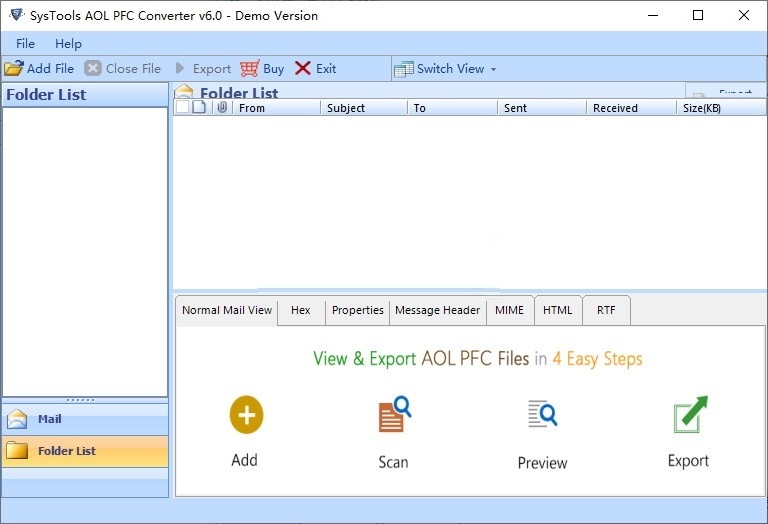

M&A and Market Entry Barriers

The method of quickly acquiring market share and capabilities through mergers and acquisitions has become one of the main strategic categories of many large companies. Zynga is a typical example. It has successfully established a leading position in the category of business simulation games with the help of a series of acquisitions. However, looking at this situation from the opposite perspective, we can find that this also implies the possibility of diversifying resources. In the field of puzzle games that it was originally good at, its influence and market share have been challenged by emerging forces.

For studios working on new independent game production, it has become extremely difficult to break into the field of puzzle games. Gone are the days when millions of dollars could be earned with just an innovative core gameplay and a few maps. Today, the market entry threshold has increased significantly, and competition focuses on comprehensive operational levels, continuous content updates, and mature commercialization planning.

New opportunities brought by innovative gameplay

Even though the threshold has been raised, innovation is still the key to opening up the market. In the broad category of puzzle solving, there are still opportunities for development of creative products that incorporate many other elements. For example, games that combine puzzle solving with "merge" mechanics have shown strong growth in recent years. Such products rely on the integration of gameplay to create a new experience and successfully attract a large number of users.

Success often belongs to teams that have both creativity and execution. They must not only have unique product ideas, but also accurately grasp the right opportunity for the market to accept new gameplay, and have the technical and operational capabilities to perfectly realize their ideas. Breaking through with the right products at the right time has always been an unbreakable rule in the game industry.

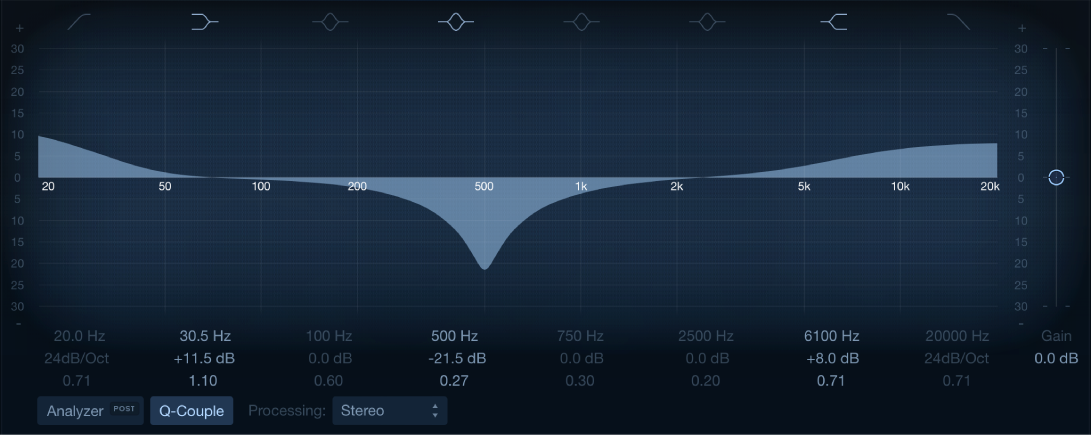

Fundamental changes in marketing logic

The market has changed, and this change has had a profound impact on the marketing logic of casual games. Free games increasingly rely on performance advertising to acquire users. As a result, the purchase cost continues to increase significantly. In view of this, developers must focus more on the unique features of the product itself, which covers core selling points and other aspects, that is, the differentiated performance in themes and gameplay. They must no longer rely on excessive aggressive marketing investment to cover up the general level of the product as in the past.

Small and medium-sized developers, with stable daily active users and good income, have increasingly become acquisition targets of large game companies in this high-cost environment, accelerating industry consolidation. Because for a large company, the risk and cost of acquiring a proven product and team may be lower than starting from scratch and requiring high purchases to promote a new game. This indicates that market concentration may further increase in the future.

After reading the market development from 2021 until now, what do you think is the situation for small and medium-sized game teams? Should they stick to the traditional category of puzzle solving to carry out micro-innovation, or should they go all out to bet on emerging segmented tracks such as merge gameplay? You are welcome to share your own opinions in the comment area. If you find that this analysis is enlightening, please also like it to support it.